Volunteer Income Tax Assistance Program

Lakes and Pines Volunteer Income Tax Assistance (VITA) program has been providing free tax preparation since 2006. We offer free help to prepare both federal and state tax returns for households with an annual income of $67,000 or less, persons with disabilities, limited English-speaking taxpayers and people 60 and over regardless of their income.

Lakes and Pines provides free tax preparation to low and moderate income individuals and families through partnership with the MN Department of Revenue and the Internal Revenue Service, and the skills and dedication of IRS-certified volunteers.

We have prepared thousands of returns, totaling more than $15 million in refunds.

Our volunteers are trained and certified by the IRS. Every tax return we prepare is processed with Quality Control Assurance. Taxes may be prepared in person or virtually. Preparing your own tax return is an option too by coming to a tax site and using a laptop with the tax software while having a trained tax-preparer available in case you have a question or two.

We can access interpreter services if you need assistance with translating our services into English.

In accordance with federal and state laws, Lakes and Pines CAC is an equal opportunity employer, contractor, volunteer coordinator and provider of services.

Lakes and Pines provides free tax preparation to low and moderate income individuals and families through partnership with the MN Department of Revenue and the Internal Revenue Service, and the skills and dedication of IRS-certified volunteers.

We have prepared thousands of returns, totaling more than $15 million in refunds.

Our volunteers are trained and certified by the IRS. Every tax return we prepare is processed with Quality Control Assurance. Taxes may be prepared in person or virtually. Preparing your own tax return is an option too by coming to a tax site and using a laptop with the tax software while having a trained tax-preparer available in case you have a question or two.

We can access interpreter services if you need assistance with translating our services into English.

In accordance with federal and state laws, Lakes and Pines CAC is an equal opportunity employer, contractor, volunteer coordinator and provider of services.

Why use Lakes and Pines Free Tax Services?

Many people are paying high fees for tax preparation services and/or give up much of their refund by participating in Refund Anticipation Loans (RALs). When all the costs are added up, taxpayers can be spending more than 10% of their refund just to get the money a few days sooner.

At Lakes and Pines tax sites trained volunteers will prepare your return for free. Returns are reviewed for accuracy and filed electronically after you give your permission. The direct deposit option to receive refunds is encouraged.

SCHEDULE AN APPOINTMENT On January 21, 2025 the first weeks of the tax calendar will be opened and we’ll start scheduling appointments at the free tax preparation sites. Tax preparation appointments are dependent on volunteer availability. Appointment schedules will be created as volunteers commit to work at tax sites. To make an appointment call 1-320-679-1800 or 1-800-832-6082 (Press 4 at prompt) Check this page and Lakes and Pines’ Facebook page for tax site calendar updates. The more trained and certified volunteers we have equals more appointments. Contact us if you want to volunteer.

We cannot prepare taxes for the following: daycares, clergy, corporations, LLC, partnerships, rental income, farm or hobby income, international students, businesses with employees, Form 1115 foreign tax, any tax filing requirements for cryptocurrency, businesses with inventory, or self-employment with more than $5000 in expenses.

For multiple year tax preparation - contact tax staff to schedule your appointment.

DIY Option

Take charge of your taxes and try using our DIY Program. If you made less than $89,000 you can qualify to use our completely free tax software with support from our volunteers. If you are comfortable working on a computer you can probably complete your own tax return. Contact us for more information.

New filing method for renters!

Beginning with tax year 2024, renters will no longer file a Renter's Property Tax Refund return (Form M1PR). Instead, the credit will be added to your income tax return. For details, visit Renter's Credit. If you need to file for only your Property Tax or Rent Refund please contact us after March 15 to schedule your appointment. The tax preparation appointments in February and early March are intended for those that need to file income tax returns.

At Lakes and Pines tax sites trained volunteers will prepare your return for free. Returns are reviewed for accuracy and filed electronically after you give your permission. The direct deposit option to receive refunds is encouraged.

SCHEDULE AN APPOINTMENT On January 21, 2025 the first weeks of the tax calendar will be opened and we’ll start scheduling appointments at the free tax preparation sites. Tax preparation appointments are dependent on volunteer availability. Appointment schedules will be created as volunteers commit to work at tax sites. To make an appointment call 1-320-679-1800 or 1-800-832-6082 (Press 4 at prompt) Check this page and Lakes and Pines’ Facebook page for tax site calendar updates. The more trained and certified volunteers we have equals more appointments. Contact us if you want to volunteer.

We cannot prepare taxes for the following: daycares, clergy, corporations, LLC, partnerships, rental income, farm or hobby income, international students, businesses with employees, Form 1115 foreign tax, any tax filing requirements for cryptocurrency, businesses with inventory, or self-employment with more than $5000 in expenses.

For multiple year tax preparation - contact tax staff to schedule your appointment.

DIY Option

Take charge of your taxes and try using our DIY Program. If you made less than $89,000 you can qualify to use our completely free tax software with support from our volunteers. If you are comfortable working on a computer you can probably complete your own tax return. Contact us for more information.

New filing method for renters!

Beginning with tax year 2024, renters will no longer file a Renter's Property Tax Refund return (Form M1PR). Instead, the credit will be added to your income tax return. For details, visit Renter's Credit. If you need to file for only your Property Tax or Rent Refund please contact us after March 15 to schedule your appointment. The tax preparation appointments in February and early March are intended for those that need to file income tax returns.

BRING THESE DOCUMENTS TO YOUR APPOINTMENT.

We want to do your taxes right and get you the maximum refund. In order to do that, you will need to provide ALL of the necessary documents when you come in for your appointment.If filing as a married couple, both taxpayers need to be present.

1. PERSONAL INFORMATION

*Picture ID for all taxpayers on the return

*Birthdate for all persons listed on the tax return

*Social Security card or Individual Tax Identification Number (ITIN) card or letter for all persons listed on the tax return

*Routing and account numbers for your savings account, checking account, and/or prepaid card if you want direct deposit

2. YEAR-END INCOME STATEMENTS

*W-2s for each job

*1099 forms for retirement, Social Security, unemployment, interest, dividends, stock sales, and miscellaneous income

*Year-end amounts for MFIP, SSI, MSA, GA, veterans’ benefits, workers’ compensation

3. EDUCATION AND CHILD CARE CREDITS

*Record of educational expenses you paid for your children in grades K-12. You may pick up a save your education expense receipts envelope at any Lakes and Pines office.

*Tuition expenses paid for you or your child to attend a college or university (Form 1098-T)

*Student loan interest statement (Form 1098-E)

*Child care expenses: Provider name, address, tax ID, or Social Security number

4. PROPERTY TAX REFUNDS AND DEDUCTIONS

NOTE: PROPERTY TAX AND RENTER REFUND FORMS WILL NOT BE COMPLETED UNTIL MARCH OR LATER

*Homeowners: Mortgage interest and real estate taxes Property Tax statement mailed by the county in March

*Renters: Certificate of Rent Paid (CRP)

*Mobile Home Owners: If volunteers are available, we will schedule a day to complete your M1PR in late July or early August, after the statement of tax due has been provided.

5. ADDITIONAL DOCUMENTS

*Previous year’s tax return

*Verification of health insurance (Form 1095-A)

*Record of charitable donations

1. PERSONAL INFORMATION

*Picture ID for all taxpayers on the return

*Birthdate for all persons listed on the tax return

*Social Security card or Individual Tax Identification Number (ITIN) card or letter for all persons listed on the tax return

*Routing and account numbers for your savings account, checking account, and/or prepaid card if you want direct deposit

2. YEAR-END INCOME STATEMENTS

*W-2s for each job

*1099 forms for retirement, Social Security, unemployment, interest, dividends, stock sales, and miscellaneous income

*Year-end amounts for MFIP, SSI, MSA, GA, veterans’ benefits, workers’ compensation

3. EDUCATION AND CHILD CARE CREDITS

*Record of educational expenses you paid for your children in grades K-12. You may pick up a save your education expense receipts envelope at any Lakes and Pines office.

*Tuition expenses paid for you or your child to attend a college or university (Form 1098-T)

*Student loan interest statement (Form 1098-E)

*Child care expenses: Provider name, address, tax ID, or Social Security number

4. PROPERTY TAX REFUNDS AND DEDUCTIONS

NOTE: PROPERTY TAX AND RENTER REFUND FORMS WILL NOT BE COMPLETED UNTIL MARCH OR LATER

*Homeowners: Mortgage interest and real estate taxes Property Tax statement mailed by the county in March

*Renters: Certificate of Rent Paid (CRP)

*Mobile Home Owners: If volunteers are available, we will schedule a day to complete your M1PR in late July or early August, after the statement of tax due has been provided.

5. ADDITIONAL DOCUMENTS

*Previous year’s tax return

*Verification of health insurance (Form 1095-A)

*Record of charitable donations

DIY Taxes - Who is a good fit

The free DIY tax prep option is best for people who answer yes to ALL of the following questions.

● Did you have Adjusted Gross Income (AGI) of $89,000 or less in 2025?

● Are you comfortable using a desktop or laptop computer?

● Do you have easy, reliable access to email that you use regularly?

● Do you have reliable, secure home internet service? OR are willing to prepare your taxes at one of Lakes and Pines tax sites using either your laptop or one of ours?

● Are you comfortable reading and following written instructions?

● Do you have a copy of your 2024 tax return, or do you know your 2024 AGI?

People with the following situations typically are not able to use the free DIY option:

● Only have internet access via a cell phone

● Made over $89,000 AGI in 2025

● Need to file return(s) prior to tax year 2025

● Need to file an amendment for any tax year

People with these tax situations can use the DIY Tax Prep software, but it is important they have a good understanding of their specific tax requirements as these type of returns are often more involved or beyond our volunteers’ training:

● Self-employed

● Filing for education tax credits (college/university/post-secondary students)

● Topics that are out-of-scope for the Lakes & Pines Tax Program (e.g. rental income, bankruptcy, or clergy income)

● Filing multiple state returns. Note: You can file for other states via the software, but Lakes & Pines Tax Program volunteers are not trained to help with returns for states other than MN. Support is limited for non-Minnesota returns, if you run into issues.

● Form 1040-NR

● Need to amend their 2025 return (the original return must have been prepared using TaxSlayer DIY Tax Prep software)

Our Do-it-Yourself Tax Prep resources include:

● A link to create a free TaxSlayer account so you can prepare and electronically file your federal and state income taxes as well as the Minnesota property tax refund

● Our Do-It-Yourself Tax Prep Guide: a useful resource to help you navigate tax situations and the tax software

● Support via email and phone to get you over the finish line and file if you get stuck in your tax return

This link to create a free account so you can prepare and electronically file your federal and state income taxes as well as the Minnesota property tax refund.

If you have questions about the DIY Tax Prep service or want to schedule a date and time to come to one of the tax sites to DIY your taxes, get in touch! Email us at taxes@lakesandpines.org or call 320-679-1800, option 4 and ask to be added to the DIY list or to leave a message for the DIY tax staff if you have questions. We will reply within three business days. Please don’t share information containing your Social Security number, ITIN, account password, or other private information via email or in voicemails.

● Did you have Adjusted Gross Income (AGI) of $89,000 or less in 2025?

● Are you comfortable using a desktop or laptop computer?

● Do you have easy, reliable access to email that you use regularly?

● Do you have reliable, secure home internet service? OR are willing to prepare your taxes at one of Lakes and Pines tax sites using either your laptop or one of ours?

● Are you comfortable reading and following written instructions?

● Do you have a copy of your 2024 tax return, or do you know your 2024 AGI?

People with the following situations typically are not able to use the free DIY option:

● Only have internet access via a cell phone

● Made over $89,000 AGI in 2025

● Need to file return(s) prior to tax year 2025

● Need to file an amendment for any tax year

People with these tax situations can use the DIY Tax Prep software, but it is important they have a good understanding of their specific tax requirements as these type of returns are often more involved or beyond our volunteers’ training:

● Self-employed

● Filing for education tax credits (college/university/post-secondary students)

● Topics that are out-of-scope for the Lakes & Pines Tax Program (e.g. rental income, bankruptcy, or clergy income)

● Filing multiple state returns. Note: You can file for other states via the software, but Lakes & Pines Tax Program volunteers are not trained to help with returns for states other than MN. Support is limited for non-Minnesota returns, if you run into issues.

● Form 1040-NR

● Need to amend their 2025 return (the original return must have been prepared using TaxSlayer DIY Tax Prep software)

Our Do-it-Yourself Tax Prep resources include:

● A link to create a free TaxSlayer account so you can prepare and electronically file your federal and state income taxes as well as the Minnesota property tax refund

● Our Do-It-Yourself Tax Prep Guide: a useful resource to help you navigate tax situations and the tax software

● Support via email and phone to get you over the finish line and file if you get stuck in your tax return

This link to create a free account so you can prepare and electronically file your federal and state income taxes as well as the Minnesota property tax refund.

If you have questions about the DIY Tax Prep service or want to schedule a date and time to come to one of the tax sites to DIY your taxes, get in touch! Email us at taxes@lakesandpines.org or call 320-679-1800, option 4 and ask to be added to the DIY list or to leave a message for the DIY tax staff if you have questions. We will reply within three business days. Please don’t share information containing your Social Security number, ITIN, account password, or other private information via email or in voicemails.

Join Our Team: Become a VITA Volunteer Hero!

Are you ready to make a meaningful impact in your community? Lakes and Pines is excited to invite you to become a Volunteer Income Tax Assistance (VITA) volunteer! We're looking for dedicated individuals to help us provide free tax preparation services to low-to-moderate income taxpayers during the upcoming tax filing season. Our program thrives because of the incredible support of volunteers like you!

Where You Can Help

We have several tax sites in need of volunteers, including: Cambridge, Milaca, Mora, Moose Lake, North Branch, and Pine City. Choose a location that works best for you and join us in making a difference!

No Experience? No Worries!

If you're new to taxes, don't fret! We offer comprehensive training to ensure you're prepared for your role. And if tax preparation isn't for you, we have other exciting positions available:

Greeter

-Be the friendly face that keeps our tax clinics running smoothly. You'll check people in and out and ensure they have all the necessary documents before seeing a tax preparer.

Intake Specialist

-Play a crucial part in our clinics by doing the intake interview and entering taxpayer data before a preparer completes the return. This role is vital in managing the clinic's time efficiently.

Tax Preparer

-Use your skills to prepare tax returns and help our clients receive their maximum refund. Your expertise will be invaluable!

Training Starts Soon!

All volunteers will receive training to ensure you're ready for your role. Training begins in January, so there's plenty of time to get you prepared and excited for this rewarding experience.

Ready to learn more and get involved? Simply fill out the Google Survey link here or below, to start your journey as a VITA volunteer hero. Together, we can make a significant difference in the lives of those in our community!

Tax Volunteer Interest Form

Where You Can Help

We have several tax sites in need of volunteers, including: Cambridge, Milaca, Mora, Moose Lake, North Branch, and Pine City. Choose a location that works best for you and join us in making a difference!

No Experience? No Worries!

If you're new to taxes, don't fret! We offer comprehensive training to ensure you're prepared for your role. And if tax preparation isn't for you, we have other exciting positions available:

Greeter

-Be the friendly face that keeps our tax clinics running smoothly. You'll check people in and out and ensure they have all the necessary documents before seeing a tax preparer.

Intake Specialist

-Play a crucial part in our clinics by doing the intake interview and entering taxpayer data before a preparer completes the return. This role is vital in managing the clinic's time efficiently.

Tax Preparer

-Use your skills to prepare tax returns and help our clients receive their maximum refund. Your expertise will be invaluable!

Training Starts Soon!

All volunteers will receive training to ensure you're ready for your role. Training begins in January, so there's plenty of time to get you prepared and excited for this rewarding experience.

Ready to learn more and get involved? Simply fill out the Google Survey link here or below, to start your journey as a VITA volunteer hero. Together, we can make a significant difference in the lives of those in our community!

Tax Volunteer Interest Form

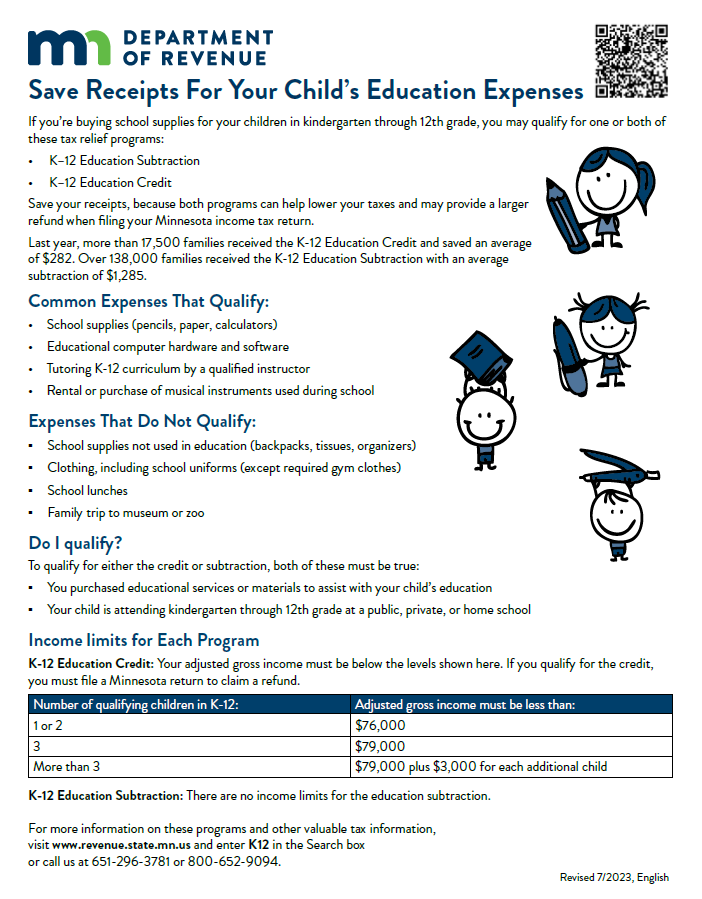

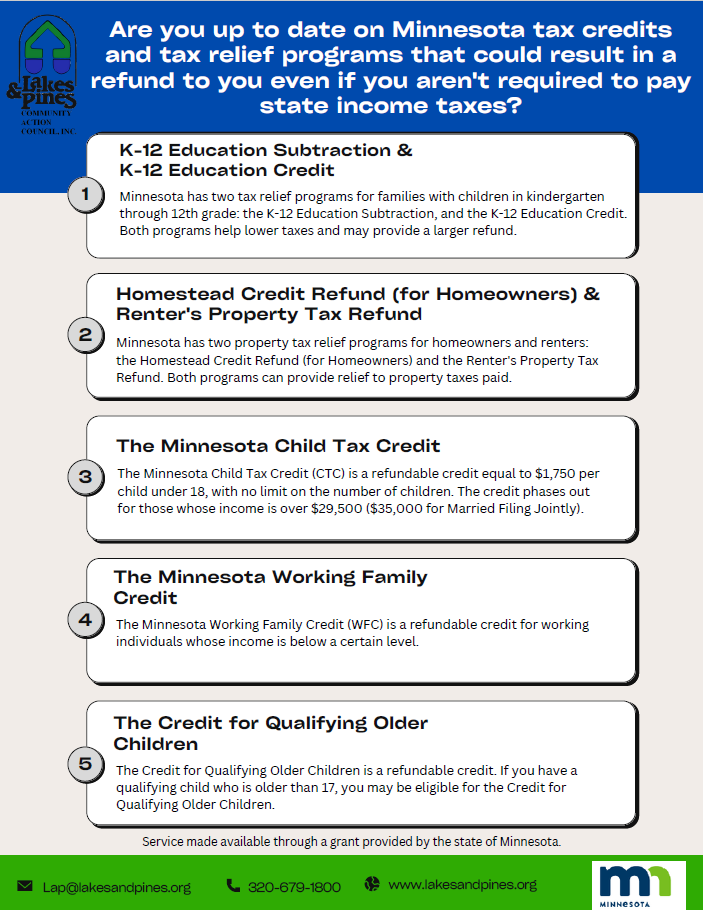

Education Tax Assistance

Minnesota has two tax relief programs for families with children in kindergarten through 12th grade: the K-12 Education Subtraction, and the K-12 Education Credit. Both programs help lower taxes and may provide a larger refund.

Click here for more information